How to calculate a monthly bonus in 1s 8.3. Payments in the inter-settlement period

At the very beginning of work with the program 1C ZUP 8 in its initial setup, you can refer to the assistant "Initial setup of the program".

Fig 1. Processing "Initial setting of the program"

Processing allows you to enter initial information about the organization, fill out an accounting policy, as well as settings for personnel accounting and payroll. Based on the entered data, accruals and deductions are created in the assistant.

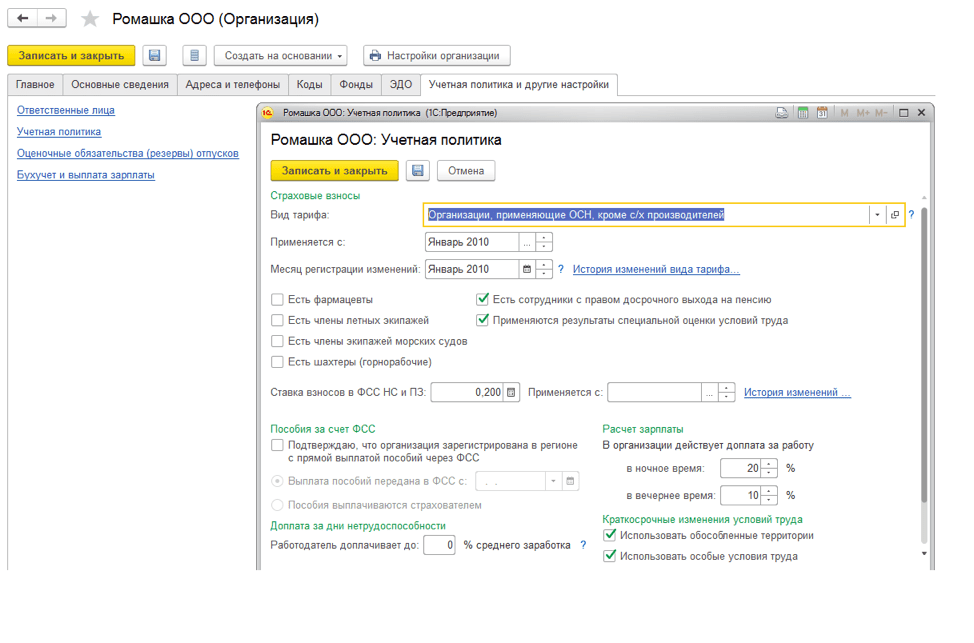

Fig 2. Accounting policy of the organization

Fig 2. Accounting policy of the organization

All entered settings for the personnel and design contour can be viewed or corrected in the "Settings" subsystem.

Fig 3. Adjustment by personnel and design contour

Basic settings affecting payroll calculation:

- The income is paid to the former employees of the enterprise. When this setting is installed, the document "Payment to former employees" will be available in the program, which allows you to register material assistance to former employees, saved earnings for the period of employment, etc. Registered payments are reflected in the report "Non-salary income";

- Several tariff rates are used for one employee. When this setting is installed, the block * “Add. tariffs, coefficients ".

Rice. 4. Add. tariffs, coefficients

Rice. 4. Add. tariffs, coefficients

* In the block, you can select the payroll indicators with the method of applying the value - in all months after entering the value (permanent use) and the purpose of the indicator - for the employee. The selected indicators will be used in all employee charges, if they are specified in the calculation formula.

- Several types of time are used in the work schedule. When this setting is set in the program, custom time types will be available in the work schedules, for which predefined values of the time types “Turn-in”, “Watch”, “Night hours”, “Evening hours”, “Work at part-time mode "," Reduced time for students on the job "," Reduced working hours in accordance with the law. "

- Check the conformity of the actual time to the planned one. This setting will not allow you to post the "Timesheet" document if the actual time in the timesheet does not coincide with the work schedule or individual schedule.

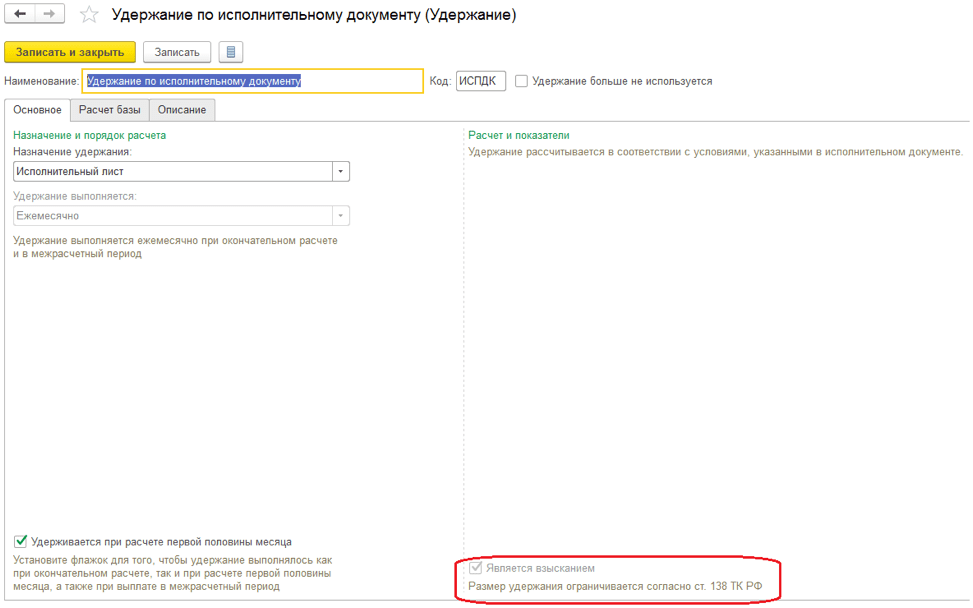

- Limit the amount of deductions to a percentage of wages. The setting will allow limiting the total amount of deductions to a percentage of wages in accordance with Art. 138 of the Labor Code of the Russian Federation. When this feature is specified in deductions, the feature "Is collection" * becomes available.

Rice. 5. Setting hold

Rice. 5. Setting hold

* When you set the specified sign, you can select the order of collection in the writ of execution, and control of the amounts of deductions in accordance with the law is carried out in the document "Limitation of collection".

- The procedure for recalculating the employee's tariff rate into the cost of an hour. The setting allows you to define the algorithm for calculating the indicators "Cost of the Day of the Hour", "Cost of the Day", "Cost of the Hour".

- Indicators that determine the composition of the aggregate tariff rate. Here is a list of indicators included in the employee's aggregate tariff rate. When calculating the indicators "Cost of the Day of the Hour", "Cost of the Day", "Cost of the Hour", the selected indicators will be used in the employee's tariff rate.

- Check the compliance of charges and payments When the setting is enabled, when you try to pay more than accrued, the program will issue a warning and the payroll will not be posted.

- Carry out additional accrual and recalculation of salaries in a separate document. When this setting is installed, all recalculations will be recorded by the document "Additional accruals, recalculations".

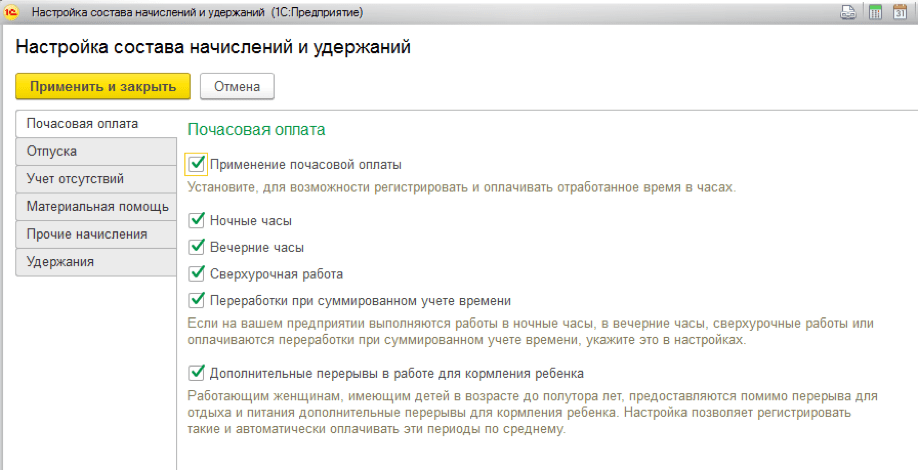

Setting up charges and deductions. Payroll indicators

Fig 6. Setting up charges and deductions

Fig 6. Setting up charges and deductions

According to the selected settings, the program creates calculation types, as well as payroll indicators that are used in the formulas for newly created accruals and deductions.

You can set up a new charge or deduction in the menu "Setting / Accruals / Holds".

Let's consider an example of creating a new charge.

Rice. 7. Setting up the accrual

Rice. 7. Setting up the accrual

The "General" tab is filled with:

- The assignment of the accrual allows you to automatically fill in some of the details of the accrual. For example, when choosing a destination - vacation payment, the accrual will be carried out by the "Vacation" document, the personal income tax code is 2012, the "Average earnings" tab will be blocked.

- Method of execution. Filling is available for certain accrual assignments, for example, when choosing an assignment - time wages and allowances. The following values are available:

- Monthly;

- According to a separate document. A choice of documents is available - a one-time charge or a bonus;

- In the months listed;

- Only if an indicator value is entered;

- Only if a time tracking type has been entered;

- Only if the time falls on holidays.

- Supports several concurrent charges. When this feature is installed, the system will allow you to enter several types of charges in one month in the context of documents of grounds.

- Include in the payroll. When installed, this charge will be included in the payroll.

- It is charged when calculating the first half of the month. When this flag is set, the type of calculation will be charged when calculating the advance with the document “Accrual for the first half of the month”.

- In the "Constant indicators" block, it is necessary to indicate for which constant indicators it is necessary to request the input of the indicator value, and for which - to clear the value when canceling the accrual.

In the calculation formula, we prescribe: TariffHourly * Percentage of the surcharge for theCharacter of work * TimeIn hours.

On the "Time tracking" tab, the type of accrual is indicated:

- For work a full shift within the normal time frame. The calculation type will record the hours worked. It is set for the main daily planned employee accrual.

- For part-time work within the normal time frame. The calculation type will record the hours worked. Installed for intra-shift accrual.

- For work in excess of the time limit. For example, it is set for an accrual that pays for work on a holiday.

- Additional payment for already paid time. Set for premiums, allowances, surcharges, etc.

- Full shifts \ Incomplete shifts. It is set for charges that are deviations from the employee's work schedule. For example, vacations, business trips, etc.

We indicate the type of time, which is taken into account in the indicators "TimeInDaysHours", "TimeInDays", "TimeInChours".

In the example, we indicate "Working time" - a predefined type of time, which includes all types of time with the set "Working time".

Rice. 8. Tab "Time tracking" accrual

Rice. 8. Tab "Time tracking" accrual

On the "Dependencies" tab, accruals and deductions are indicated, the calculation base of which includes this accrual. Preemptive charges are indicated on the "Priority" tab. On the tabs "Average earnings" and "Taxes, contributions, accounting", you can configure the procedure for accounting and taxation.

Let's create the indicator "Markup Percentage per JobCharacter".

Rice. 9. Setting up the indicator "Percentage markup for the nature of work"

Rice. 9. Setting up the indicator "Percentage markup for the nature of work"

The purpose of the indicator can be for an employee, department, organization. It can be periodic, one-time, or operational.

Periodic indicators are entered in personnel documents, one-time indicators are entered in the "Data for calculating salaries" for a month. The operational indicator can be entered by the documents "Data for the calculation of payroll" during the month, the total value is accumulated.

Applying for a job

To register the hiring of an employee, you need to create an employee card, enter the document "Hiring" or "Hiring by list".

Rice. 10. Document "Recruitment"

Rice. 10. Document "Recruitment"

On the "Main" tab, we indicate the date of admission, the number of bids, schedule, position, department and territory, if accounting policy is configured in the context of territories.

Rice. 11. Setting up the "Accounting policy" of the organization

Rice. 11. Setting up the "Accounting policy" of the organization

On the "Remuneration" tab, we select the planned charges for the employee, set the procedure for calculating the advance payment and the procedure for recalculating the employee's tariff rate into the “Cost of the Day of the Hour”, “Cost of the Day”, “Cost of the Hour” indicators when calculating overtime, holidays, etc.

If the program was transferring data from previous versions of the programs, then the above information is filled in automatically when transferring in the document "Initial staffing."

Accrual for the first half of the month

The program provides the following options for calculating an advance:

- Fixed amount;

- Percentage of the tariff;

- Calculation for the first half of the month.

The procedure for calculating and paying the advance payment is indicated in the personnel documents "Recruitment", "Personnel transfer", "Change in remuneration". To set the method for calculating the advance payment, the list of employees must use the document "Change in advance payment".

Rice. 12. Selecting the option for calculating the advance payment in the personnel document, the tab "Remuneration"

Rice. 12. Selecting the option for calculating the advance payment in the personnel document, the tab "Remuneration"

Methods of payment of an advance in a "fixed amount" and "a percentage of the tariff" do not require additional calculation and entry of documents. The payment takes place directly in the document for the payment of salaries with the nature of the payment "Advance". The method of calculation "as a percentage of the tariff" is calculated as a percentage of the payroll, i.e. all planned employee charges that are part of the payroll are taken into account.

The method of payment of the advance payment "by settlement for the first half of the month" implies the input of the document "Accrual for the first half of the month". The document contains the employee's accruals, in the settings of which the sign "Accrued when calculating the first half of the month" is set.

Rice. 13. Feature "Accrued when calculating the first half of the month"

Rice. 13. Feature "Accrued when calculating the first half of the month"

It is necessary to pay salaries for the first half of the month with a statement with the nature of the payment "Advance".

Rice. 14. Statement for advance payment

Rice. 14. Statement for advance payment

To view the results of the accrual and payment of the advance, you must use the reports "Payroll T-51 (for the first half of the month)," Payroll for the first half of the month "of the menu" Salary / Salary reports ".

Payments in the inter-settlement period

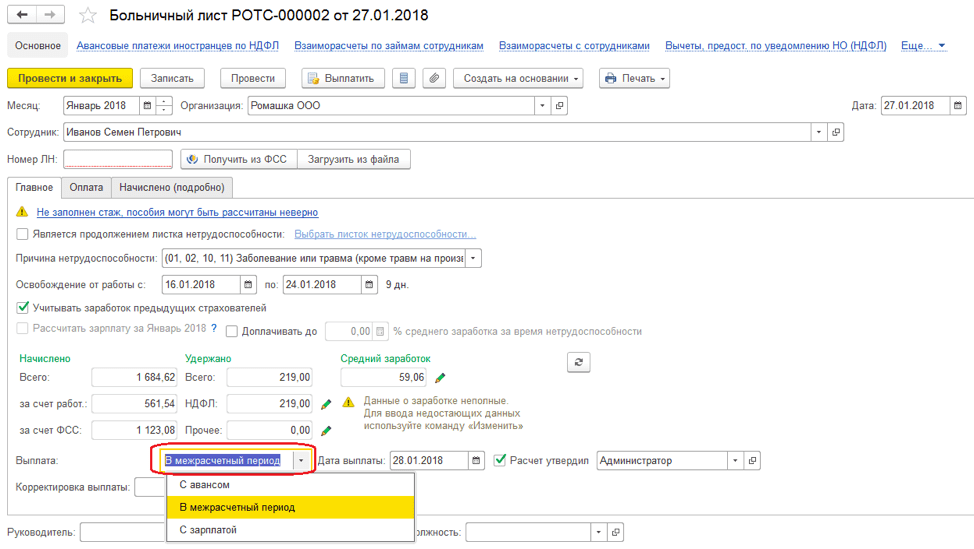

Inter-settlement payments include the calculation of vacation pay, sick leave and other deviations from the employee's work schedule.

Let us consider, for example, the calculation of temporary disability benefits.

Rice. 15. Calculation of temporary disability benefits

Rice. 15. Calculation of temporary disability benefits

The system allows you to pay benefits together:

- With advance payment. If you choose this method, the allowance will be paid in a statement with the nature of the payment "Advance";

- In the inter-settlement period. When choosing this method of payment, the system will allow you to create a document for payment based on the entered document "Sick leave";

- With a salary. If you choose this method, the allowance will be paid in a statement with the type of payment "Monthly salary".

In the field "Payment" we indicate - in the inter-settlement period. When you click on the "Pay" button, a sheet document is created with the character of payment "Sick leave".

Rice. 16. Creating a document for payment in the inter-settlement period

Rice. 16. Creating a document for payment in the inter-settlement period

Calculation and calculation of salaries. Payment of salaries in 1C 8.3 ZUP

Salary in 1C ZUP 8.3 is calculated in the document "Payroll and contributions". By clicking the "Details" button in the tabular section of the document, you can view the indicators on the basis of which this or that charge is calculated.

Rice. 17. Document "Calculation of salaries and contributions"

Rice. 17. Document "Calculation of salaries and contributions"

On the "Contracts" tab, employees are calculated under civil contracts. Employees receiving benefits up to 1.5 and up to 3 years old are calculated on the Benefits tab. Deductions, personal income tax and insurance premiums are calculated on the document tabs of the same name. On the tab “Accruals, recalculations”, the employee’s recalculations for the previous periods recorded by the “Recalculations” mechanism are recorded.

Rice. 18. Mechanism "Recalculations" of the "Salary" menu

Rice. 18. Mechanism "Recalculations" of the "Salary" menu

If the checkbox "Perform additional accruals and recalculations of salaries in a separate document" is selected in the settings, then employee recalculations are recorded in the document “Accruals, recalculations”.

To pay wages, you must enter a document sheet with the nature of the payment "Salary per month".

Rice. 19. Statement for the payment of wages

Rice. 19. Statement for the payment of wages

Reflection of salaries in 1C accounting

To reflect the results of accrual in accounting and the formation of transactions in the system, you must enter the document "Reflection of salary in accounting".

Rice. 20. Document "Reflection of salaries in accounting." Accounting for salaries in 1C

Rice. 20. Document "Reflection of salaries in accounting." Accounting for salaries in 1C

On its basis in 1C, postings are formed according to the type of operation and the method of reflection specified in the document.

In this article, 1C experts talk about setting up in"1C: ZUP 8" rev. 3types of premium calculation - codes of types of personal income tax and income categories in the case of payment of a monthly premium, a one-time bonus and an anniversary bonus (paid out of the company's profit) for correct reflection in personal income tax reporting.

How to set up "1C: Salary and Human Resource Management 8" edition 3, so that in the calculation of 6-NDFL it correctly reflects different cases of an employee receiving a bonus, taking into account standard deductions for personal income tax,.

Income codes for premium accounting

By order of November 22, 2016 No. ММВ-7-11 / [email protected] The Federal Tax Service of Russia approved income codes: 2002 and 2003 for accounting for premiums.

The necessity of dividing the premium into incomes with codes 2002 and 2003 raises the question of what is meant by the word "premium".

From the point of view of the Labor Code (Art. 129), a bonus is one of the types of incentive payments for wages. Article 135 of the Labor Code of the Russian Federation, which regulates the establishment of wages, states that bonus systems are established by collective agreements, agreements, local regulations in accordance with labor legislation and other regulatory legal acts containing labor law norms. Article 191 of the Labor Code of the Russian Federation lists the bonus as one of the means of reward for work. There is no other mention of the word “premium” in the Labor Code, and, therefore, all bonuses assigned in accordance with the Labor Code of the Russian Federation are related to wages.

So, the order of the Federal Tax Service of Russia divided all bonuses into bonuses with the code:

- 2002 - the amount of bonuses paid for production results and other similar indicators provided for by the norms of the legislation of the Russian Federation, labor agreements (contracts) and (or) collective agreements (paid not at the expense of the organization's profit, not at the expense of special purpose funds or earmarked receipts) ;

- 2003 - the amount of remuneration paid from the organization's profit, special purpose funds or earmarked income.

It is understood that rewards paid out of profit are not assigned for labor achievements, but are timed to coincide with anniversaries and holidays, and encourage sports or other creative successes. If the word “bonus” is not used in the local regulations governing such remuneration, then such payments are referred to income code 4800.

In a letter dated 07.08.2017 No. SA-4-11 / [email protected] The Federal Tax Service of Russia clarified that remuneration with an income code of 2002 includes bonuses related to wages:

- bonuses paid: based on the results of work for a month, quarter, year;

- one-time bonuses for a particularly important task;

- prizes in connection with the awarding of honorary titles, with the awarding of state and departmental awards;

- remuneration (bonuses) for achieving production results;

- bonuses paid by budgetary institutions;

- other similar premiums.

However, the Determination of the Supreme Court of the Russian Federation dated 04.16.2015 No. GK15-2718 allocates bonuses depending on the frequency and establishes that bonuses directly related to labor remuneration should be paid in the same way as wages. The date of actual receipt of income on such premiums should be considered as the last day of the month for which this premium was accrued. Thus, the Supreme Court has clarified how to qualify performance bonuses (code 2002) that have a monthly frequency.

Letter of the Ministry of Finance of Russia dated 09.29.2017 No. 03-04-07 / 63400 answers the question about the date of actual receipt of income from production bonuses (also with the code 2002) but with a different frequency: one-time, quarterly, annual. For them, the date of actual receipt of income is the day when the money was issued from the cash desk or transferred from the company's current account to the employee's card.

How to set up the types of premium calculation in "1C: ZUP 8" rev. 3

Starting from version 3.1.5.170 in the program "1C: Salary and personnel management 8" edition 3, the settings of the calculation types have been changed, in which the Accrual assignments selected Prize... The date of actual receipt of income for the premium is determined depending on Income categories. Income category is indicated in the card of the calculation type on the tab Taxes, fees, accounting and can take on the following values:

- Salary;

- ;

- Other income.

For accrual with income category Salary as Dates of actual receipt of income the 6-NDFL report sets the last day of the month for which this accrual was made.

For other charges Date of actual receipt of income in the 6-NDFL report, this is the day of the actual payment of income to the employee.

The categories available for selection are determined by the settings Type of income for personal income tax... If the card Type of income for personal income tax flag set Corresponds to wages, then Income category can be chosen:

- Salary;

- Other income from employment.

If Type of income for personal income tax not Corresponds to wages(flag not set) then categories are available for selection:

- Other income from employment;

- Other income.

Setting up types of personal income tax

Rice. 1. Setting up the types of personal income tax

Rice. 2. Setting up a bonus for production results

Setting up income categories

For performance bonuses, set Income code"2002" and, depending on the frequency of the award, choose Income category of options:

- Salary;

- Other income from employment(see fig. 2).

Rice. 3. Setting up a bonus paid from the organization's profit

For bonuses paid from the organization's profits, special purpose funds or earmarked income, a Income code 2003.

Choice given Income categories of the following options:

- Other income from employment;

- Other income(see fig. 3).

Rice. 4. Document "Award"

note that clarification of the category in this case is important for choosing the personal income tax rate for non-residents. Tax at a rate of 13% on such a premium for non-residents in accordance with paragraph 3 of Article 224 of the Tax Code of the Russian Federation in the program is calculated if Income categories - Other income from employment.

Let's consider examples of setting up bonuses in the program "1C: Salary and personnel management 8" edition 3 and reflecting 6-NDFL in the calculation.

Example 1

Monthly premium with Income code"2002" and Income category"Labor remuneration" is charged according to a separate document. The premium is stated as monthly. The month on the basis of which it is calculated, in order to determine Actual income dates- January 2018, indicated in the field Month(fig. 4).

Consequently, in Section 2 of the 6-NDFL report for the first quarter of 2018, the monthly premium for January is displayed in the lines:

130: 10,000 rubles.

140: 936 rub.

Example 2

One-time bonus with Income code"2002" and Income category

Example 3

An employee's anniversary bonus in the amount of RUB 10,000, adjusted in accordance with the above recommendations, was accrued and paid in the off-set period on February 15, 2018

Anniversary bonus for an employee with Income code"2003" and Income category"Other income from employment" is accrued on a separate document similar to Example 1.

In Section 2 of the 6-NDFL report for the I quarter of 2018, the one-time premium for January is displayed in the lines:

130: 10,000 rubles.

140: 936 rub.

note, in "1C: Salary and Human Resources Management 8" (rev. 3) it is not recommended to change the categories in the settings of bonuses accrued earlier. To avoid changes in already generated reports, it is recommended to create new types of calculation.

From the editorial board ... At the lecture “1C-Reporting for the I quarter of 2018 - new in reporting, what to look for” dated 03/29/2018, 1C experts talked about the specifics of preparing reports for the I quarter of 2018, including setting up premiums. See part of the video "The peculiarity of the preparation of" salary "reporting in" 1C: Salary and personnel management 8 "(rev. 3)". More details - in 1C: ITS .

Accountants know that payroll is a complex and demanding operation. It must be done in strict accordance with labor and tax laws. In 1C 8.3, you can keep track of all types of income, benefits, compensation. How to calculate salaries in 1C ZUP 8.3 Accounting step by step read on.

Payroll operations are inextricably linked with personnel records. It all starts with hiring an employee. It is when registering a new employee that the data are indicated, on the basis of which you will make an accrual in the future. In detail. It is also important to take into account personnel movements and dismissals of employees in the program on time. In 1C, salary and personnel, you can calculate bonuses, sick leaves, travel allowances, vacation pay, dismissal benefits, and many other payments. Read about payroll in 1C 8.3 ZUP step by step for beginners in this article.

Step 1. Enter personnel data for employees into 1C

In 1C 8.3 ZUP, all personnel operations are located in the "Personnel" section (1). For registration of hiring, transfers, dismissals, click on the link "Appointments, transfers, dismissals" (2). A window for creating personnel operations will open.

When applying for a job, you indicated the employee's salary and his work schedule. Based on this data, the program will calculate the monthly salary. How to calculate the salary, read on.

Step 2. Make payroll in 1C

On the start page, select the required organization (1).

Go to the section "Salary" (2) and click on the link "Payroll ..." (3). A window for creating an operation will open. All previously created accruals for the selected organization are visible in it.

In this window, start sequential payroll and contribution calculation. Make sure the correct organization is listed (4). Click the "Create" button (5) and click on the link "Payroll and contributions" (6). A form for calculating salaries in 1C 8.3 ZUP will open.

Here enter the month of accrual (7) and put the last date of the month (8). Then click the "Fill" button (9) and click on the "Fill" link (10).

The "Accruals" tab (11) was filled with data on employees (12) and their salaries (13). The calculation of wages is formed taking into account the days worked. If the employee was hired or dismissed in the middle of the month, then 1C 8.3 ZUP will not calculate the full salary, but will make the calculation for the days worked.

In the "Personal Income Tax" tab (14), you see the calculation of personal income tax for each employee (15). The program automatically calculates personal income tax, taking into account the deductions indicated when applying for a job. About.

In the "Contributions" tab (16), you can see the calculation of insurance premiums in the Pension Fund (17), FSS (18), FSS for accidents (19), FFOMS (20). In 1C 8.3, salary and personnel contributions are calculated automatically at the rates in force in Russia. For the FSS contribution for accidents, the rate is established in the accounting policy of the organization. To enter the accounting policy, click the "Open" icon (21). The organization card will open.

In the organization card, click on the "Accounting policy ..." tab (22) and select the "Accounting policy" link (23). Your company's accounting policy will open.

In the accounting policy window, indicate the rate of contributions to the Social Insurance Fund for accidents (24). To save the data, press the button "Save and close" (25).

Step 3. Accrual of bonuses in 1C ZUP

In 1C 8.3 ZUP, bonuses can be accrued in two ways:

- In the document "Calculation of salaries and contributions";

- In a separate document "Awards".

Accrual of bonuses in 1C in the document "Calculation of salaries and contributions"

Suppose you have already accrued salary on salaries, now you want to add bonuses to these accruals. Go to the created document "Payroll and contributions" as written in this article. Press the "Add" button (1) and select the required employee from the directory (2). Indicate the division (3), the type of bonus accrued (4) and its amount (5).

Go to the tab "Personal income tax" (6) and click the button "Recalculate personal income tax" (7). Tax (8) will be recalculated taking into account the added premium.

Then go to the "Contributions" tab (9) and click the "Recalculate contributions" button (10). Contributions (11) will also be recalculated taking into account the premium. To save the data on the accrual of bonuses, click the "Post and close" button (12).

Accrual of premiums in 1C with a separate document "Prize"

Go to the section "Salary" (1) and click on the link "Awards" (2). A window for creating an operation will open. All previously created premium charges in 1C 8.3 ZUP are visible in it.

In the window that opens, click the "Create" button (3). A form for calculating bonuses will open.

In it, indicate the month the bonus was accrued (4) and the last day of this month (5). Next, select from the directory the type of bonus accrued (6), click the "Selection" button (7) and select the required employee (8). Indicate the amount of the premium (9) and the period for which it is charged (10). To complete the operation in 1C 8.3 ZUP, click the "Post and close" button (11). The bonus has been accrued.

In the document "Prizes" there are no accruals for personal income tax and contributions. These taxes must be calculated in the document "Calculation of salaries and contributions". To do this, go to the "Salary" section (12) and click on the link "Payroll ..." (13).

Go to the accrual document, which indicates the same month (14), which was in the “Bonus” document.

In the "Personal Income Tax" tab (15), click the "Recalculate ..." button (16). Tax (17) will be recalculated taking into account the premium accrued in a separate document.

In the "Contributions" tab (18), click the "Recalculate ..." button (19). Contributions (20) will be recalculated taking into account the premium accrued in a separate document.

Step 4. Pay salary in 1C Salary and Human Resources

Go to the section “Payments” (1) and click on the link “Sheets to the cashier” (2). A window will open for creating a payment from the cash desk.

In the window that opens, click the "Create" button (3). A document for creating a payment will open.

In the "Statement to the cashier" window, indicate the month for which you are paying salaries (4) and click the "Fill" button (5). The statement will be automatically filled in with the amounts to be paid.

In the completed statement in 1C 8.3 ZUP, the amounts payable (6) and the amount of personal income tax to be transferred to the budget (7) are visible. To save and post the list, press the buttons "Save" (8) and "Post" (9). In order to print the payroll press the "Print" button (10) and select the link "Payroll (T-53)" (11). A printable payroll form opens.

Basic Payroll and Contribution Transactions

| Operation | Debit | Credit |

| Accrued wages | 20 (44,23,25,26) | 70 |

| Withheld personal income tax | 70 | 68 |

| Contributions assessed | 20 (44,23,25,26) | 69 |

| Wages paid | 70 | 50,51 |

In this article, 1C experts talk about setting up in "1C: Salary and Human Resource Management 8" rev. 3 types of premium calculation - codes of personal income tax types and income categories in the case of payment of a monthly bonus, a one-time bonus and an anniversary bonus (paid out of profit companies) for correct reflection in personal income tax reporting.

Income codes for premium accounting

By order of November 22, 2016 No. ММВ-7-11 / [email protected] The Federal Tax Service of Russia approved income codes: 2002 and 2003 for accounting for premiums.

The necessity of dividing the premium into incomes with codes 2002 and 2003 raises the question of what is meant by the word "premium".

From the point of view of the Labor Code (Art. 129), a bonus is one of the types of incentive payments for wages. Article 135 of the Labor Code of the Russian Federation, which regulates the establishment of wages, states that bonus systems are established by collective agreements, agreements, local regulations in accordance with labor legislation and other regulatory legal acts containing labor law norms. Article 191 of the Labor Code of the Russian Federation lists the bonus as one of the means of reward for work. There is no other mention of the word “premium” in the Labor Code, and, therefore, all bonuses assigned in accordance with the Labor Code of the Russian Federation are related to wages.

So, the order of the Federal Tax Service of Russia divided all bonuses into bonuses with the code:

- 2002 - the amount of bonuses paid for production results and other similar indicators provided for by the norms of the legislation of the Russian Federation, labor agreements (contracts) and (or) collective agreements (paid not at the expense of the organization's profit, not at the expense of special purpose funds or earmarked receipts) ;

- 2003 - the amount of remuneration paid from the organization's profit, special purpose funds or earmarked income.

It is understood that rewards paid out of profit are not assigned for labor achievements, but are timed to coincide with anniversaries and holidays, and encourage sports or other creative successes. If the word “bonus” is not used in the local regulations governing such remuneration, then such payments are referred to income code 4800.

In a letter dated 07.08.2017 No. SA-4-11 / [email protected] The Federal Tax Service of Russia clarified that remuneration with an income code of 2002 includes bonuses related to wages:

- bonuses paid: based on the results of work for a month, quarter, year;

- one-time bonuses for a particularly important task;

- prizes in connection with the awarding of honorary titles, with the awarding of state and departmental awards;

- remuneration (bonuses) for achieving production results;

- bonuses paid by budgetary institutions;

- other similar premiums.

However, the Determination of the Supreme Court of the Russian Federation dated 04.16.2015 No. GK15-2718 allocates bonuses depending on the frequency and establishes that bonuses directly related to labor remuneration should be paid in the same way as wages. The date of actual receipt of income on such premiums should be considered as the last day of the month for which this premium was accrued. Thus, the Supreme Court has clarified how to qualify performance bonuses (code 2002) that have a monthly frequency.

Letter of the Ministry of Finance of Russia dated 09.29.2017 No. 03-04-07 / 63400 answers the question about the date of actual receipt of income from production bonuses (also with the code 2002) but with a different frequency: one-time, quarterly, annual. For them, the date of actual receipt of income is the day when the money was issued from the cash desk or transferred from the company's current account to the employee's card.

How to set up the types of premium calculation in "1C: ZUP 8" rev. 3

Starting from version 3.1.5.170 in the program "1C: Salary and personnel management 8" edition 3, the settings of the calculation types have been changed, in which the Accrual assignments selected Prize... The date of actual receipt of income for the premium is determined depending on Income categories. Income category is indicated in the card of the calculation type on the tab Taxes, fees, accounting and can take on the following values:

- Salary;

- ;

- Other income.

For accrual with income category Salary as Dates of actual receipt of income the 6-NDFL report sets the last day of the month for which this accrual was made.

For other charges Date of actual receipt of income in the 6-NDFL report, this is the day of the actual payment of income to the employee.

The categories available for selection are determined by the settings Type of income for personal income tax... If the card Type of income for personal income tax flag set Corresponds to wages, then Income category can be chosen:

- Salary;

- Other income from employment.

If Type of income for personal income tax not Corresponds to wages(flag not set) then categories are available for selection:

- Other income from employment;

- Other income.

Setting up types of personal income tax

Rice. 1. Setting up the types of personal income tax

Rice. 2. Setting up a bonus for production results

Setting up income categories

For performance bonuses, set Income code"2002" and, depending on the frequency of the award, choose Income category of options:

- Salary;

- Other income from employment(see fig. 2).

Rice. 3. Setting up a bonus paid from the organization's profit

For bonuses paid from the organization's profits, special purpose funds or earmarked income, a Income code 2003.

Choice given Income categories of the following options:

- Other income from employment;

- Other income(see fig. 3).

Rice. 4. Document "Award"

note that clarification of the category in this case is important for choosing the personal income tax rate for non-residents. Tax at a rate of 13% on such a premium for non-residents in accordance with paragraph 3 of Article 224 of the Tax Code of the Russian Federation in the program is calculated if Income categories - Other income from employment.

Let's consider examples of setting bonuses in the program "1C: Salary and personnel management 8" edition 3 and reflecting 6NDFL in the calculation.

Example 1

Monthly premium with Income code"2002" and Income category"Labor remuneration" is charged according to a separate document. The premium is stated as monthly. The month on the basis of which it is calculated, in order to determine Actual income dates- January 2018, indicated in the field Month(fig. 4).

Therefore, in Section 2 of the 6NDFL report for the first quarter of 2018, the monthly premium for January is displayed in the rows:

130: 10,000 rubles.

140: 936 rub.

Example 2

One-time bonus with Income code"2002" and Income category

130: 10,000 rubles.

140: 936 rub.

Example 3

An employee's anniversary bonus in the amount of RUB 10,000, adjusted in accordance with the above recommendations, was accrued and paid in the off-set period on February 15, 2018

Anniversary bonus for an employee with Income code"2003" and Income category"Other income from employment" is accrued on a separate document similar to Example 1.

In Section 2 of the 6NDFL report for the first quarter of 2018, the one-time premium for January is displayed in the lines:

130: 10,000 rubles.

140: 936 rub.

note, in "1C: Salary and Human Resources Management 8" (rev. 3) it is not recommended to change the categories in the settings of bonuses accrued earlier. To avoid changes in already generated reports, it is recommended to create new types of calculation.

Send this article to my mail

Calculate a bonus in 1C ZUP is a standard operation provided by the program. To calculate the premium in 1C ZUP, you need to perform a few simple steps, which we will consider in this article.

Employee bonuses refer to incentive payments (Article 129 of the Labor Code of the Russian Federation), organizations reward their conscientious employees. Organizations have the right to independently develop various planning systems, indicators and conditions for the payment of bonuses, which they familiarize employees with - by signing orders, collective agreements, etc.

Incentives to employees are included in the payroll fund, and despite the fact that Art. 136 of the Labor Code of the Russian Federation obliges organizations to set specific dates for the payment of wages, these requirements do not apply to bonuses. The company has the right to provide bonuses to employees of the company within independently established terms, depending on the specific conditions for fulfilling the bonus indicators, and an assessment of performance indicators has been carried out, for example, for the reporting year (Letter of the Ministry of Labor dated 02.14.2017 No 14-1 / OOG-1293, dated 19.09. 2016 No.14-1 / B-889). The main thing is that the procedure for the payment of incentives should be fixed in the provision on bonuses, orders or collective (labor) agreements, i.e. employees must understand for the performance of which particular indicators, the achievement of results of the company's work, they will receive the due incentive payments.

Please leave in the comments the topics you are interested in so that our experts can analyze them in instructional articles and video instructions.

Do not forget that any payments in favor of employees, except for gifts of less than 4,000 rubles, are the basis for personal income tax (clause 1 of article 210 of the Tax Code of the Russian Federation). It is necessary to transfer the withheld personal income tax:

on the last day of the month for which the incentive was accrued, according to the amounts within the framework of the employment relationship,

on the day of payment of incentives for income that, in accordance with the Labor Code of the Russian Federation, are not part of the remuneration.

This position of the Ministry of Finance of the Russian Federation is determined by the letter dated 04.04.2017 No BS-4-11 / [email protected]

With regard to insurance premiums, it is safer for all premiums to be included in the base for calculating insurance premiums. This is due to the fact that before the termination of the law of July 24, 2009 No. 212-FZ, there is an ambiguous judicial practice, and the courts have not worked out a single decision on this issue. At the same time, the regulatory authorities express themselves unequivocally that bonuses to employees are subject to taxation of insurance premiums (Letters of the Ministry of Finance of the Russian Federation of 02/07/2017 No. 03-15-05 / 6368, of 11/16/2016 No. 03-04-12 / 67082 of the Ministry of Labor of the Russian Federation of 02.09. 2013 No. 02.09.2013 No. 17-3 / 1450). The exception is bonuses paid at the time of dismissal to employees on any holiday dates (clause 1, clause 1 of article 420 of the Tax Code of the Russian Federation, clause 1 of article 20.1. Law No. 125-FZ of July 24, 1998).

For the purposes of accounting for income tax, the costs of incentivizing employees are recognized (clause 4 of article 272, clause 1 of clause 3 of article 273 of the Tax Code of the Russian Federation):

on accrual basis - in the month of their accrual,

at cash register - in the month of their payment.

If we consider incentive payments to retired employees, then the costs of them can also be taken into account for profit tax purposes, but subject to a number of conditions (clause 1 of article 252, clause 2 of article 255, clause 1, 21, 22 Art.270 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance of the Russian Federation dated October 2, 2005 No. 03-0304 / 1/294):

consolidation by a local regulatory document,

due to the fulfillment of certain performance indicators,

documented and economically justified,

the source of payments is not net profit, targeted receipts.

Let's move on to the direct question of how to calculate the premium in 1 C ZUP. The tool for calculating incentive payments is located on the "Salary" tab, then select the "Awards" link

When you open the bookmark, all similar accrual documents appear

After that you need to select "Type of premium". The program has predefined 2 types, but in practice, if necessary, you can create additional types

The period for which the accrual occurs is determined

We select the period from 04/01/2018 to 06/30/2018 (2nd quarter), and then, by clicking the "Selection" button, we will see only those employees who worked during this period

Setting the amount of the premium

This amount will be automatically assigned to each employee

If there are employees who need to change the amount of charges, then the data is adjusted manually

After that, we visually check and carry out the document.

By clicking the "Print" button, you can generate orders for signature by the head and familiarization of employees.

A team of experienced 1c programmers:

From 5 minutes response time to urgent tasks, even on weekends and holidays.

30+ programmers with up to 20 years of experience in 1C.

We make video instructions on the completed tasks.

Live communication through any messengers convenient for the client

Control over the implementation of your tasks through an application specially developed by us

Official partners of 1C since 2006.

Experience in successful automation from small firms to large corporations.

99% of customers are satisfied with the results